Table of Contents Exploring Holiday Traditions Local Community Events Affordable Holiday Activity Ideas Get in Touch with CSB For many people, the holiday season is filled with shopping, celebrations—and stress. Family gatherings and finding the right gifts can be a source of joy and stress at the same time. Financial concerns are a top cause of stress during the holidays. …

Cyber Security and Protecting Your Financial Information

Table of Contents Every year, the risk of cyber security threats continues to grow. In 2023, there were over 2,300 cyber attacks in the US, with more than 300 million victims of these scams. By 2028, it’s predicted that cybercrime will cost the country nearly $2 trillion. With October being Cybersecurity Awareness Month, we’re here to offer advice and guidance …

Preparing for Homeownership: A Checklist for First-Time Buyers in Colorado

Table of Contents: Whether you’ve lived in Colorado for your whole life or you’re a new resident of the state, buying your first home here can feel overwhelming. With rising home costs and a competitive housing market, getting your foot on the real estate ladder may seem impossible. But with preparation ahead of time, you could be holding the keys …

Financial Planning for Fall: Getting Ready for the End of the Year

Table of Contents: Fall is the perfect time to reflect on your financial year and prepare for winter expenses. Even if you had a terrific year highlighted by sticking to your budget, funding an emergency savings account, and paying off debt, there are likely still goals that you would like to accomplish next year. By assessing your financial wins and …

Master Your Money: A Beginner’s Guide to the Zero Budget Method

Table of Contents Are you looking for an easy and flexible way to manage your money? A budget is an important part of your overall financial wellness. With zero-based budgeting, you have to give every dollar a job. This intentional, yet still flexible approach can help you control spending and reach your financial goals faster. In this article, we’ll explain …

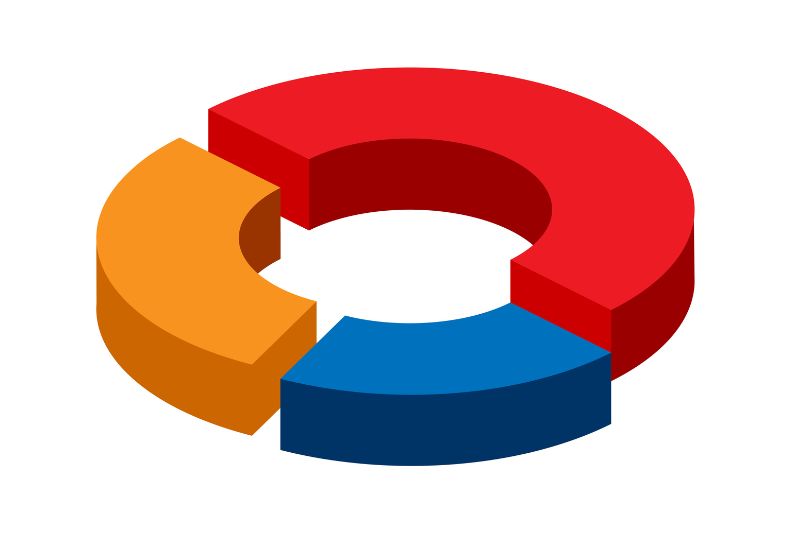

Transform Your Wallet: The Power of 50/30/20 Budgeting Method

If you’re looking for a practical and adaptable framework for managing your finances, the 50/30/20 budgeting method may be the right solution for you. Dividing your after-tax income into basic categories including essential needs, personal wants, and financial goals, this approach not only helps you to effectively track and control your expenses, but also ensures that your long-term financial well-being …

Financial Fitness: How to Save $1,000 Quickly

We all know that it’s important to have money set aside for the future—whether it’s long-term goals or a rainy-day fund for unexpected expenses. Unfortunately, saving money isn’t always easy. Whether you’re living paycheck to paycheck, are struggling with debt, or simply never developed the habit, like many others, you may find it difficult to prioritize saving money. In fact, …

Master Your Money: A Quiz to Test Your Financial Literacy

Citizens State Bank is proud to celebrate Financial Literacy Awareness Month this April by inviting you to participate in our Financial Literacy Quiz! We believe in empowering our community with the knowledge and tools necessary for financial wellness. Our quiz is designed to test your understanding of basic financial concepts, including saving, investing, budgeting, and credit management. Whether you’re a …

Revamping Your Colorado Home: Top Renovation Ideas

Colorado’s growing economy, natural beauty, and lifestyle appeal have contributed to a steady increase in home values. This can create conditions ripe for home renovations for two important reasons. Firstly, current homeowners may find it makes more sense to renovate their existing homes, rather than face a tight real estate market. Additionally, that increased equity in homes can be converted …

From Ground Up: A Step-By-Step Home Construction Financing Guide

Building a home is a complex process. From finding the right location to creating the plans, it’s not an undertaking to go into lightly. To add to the intricacy of the process, financing for building a home—versus buying an existing home—is also more complicated. Many individuals building their homes will go through three separate lending products (or more!) in order …

- Page 1 of 2

- 1

- 2