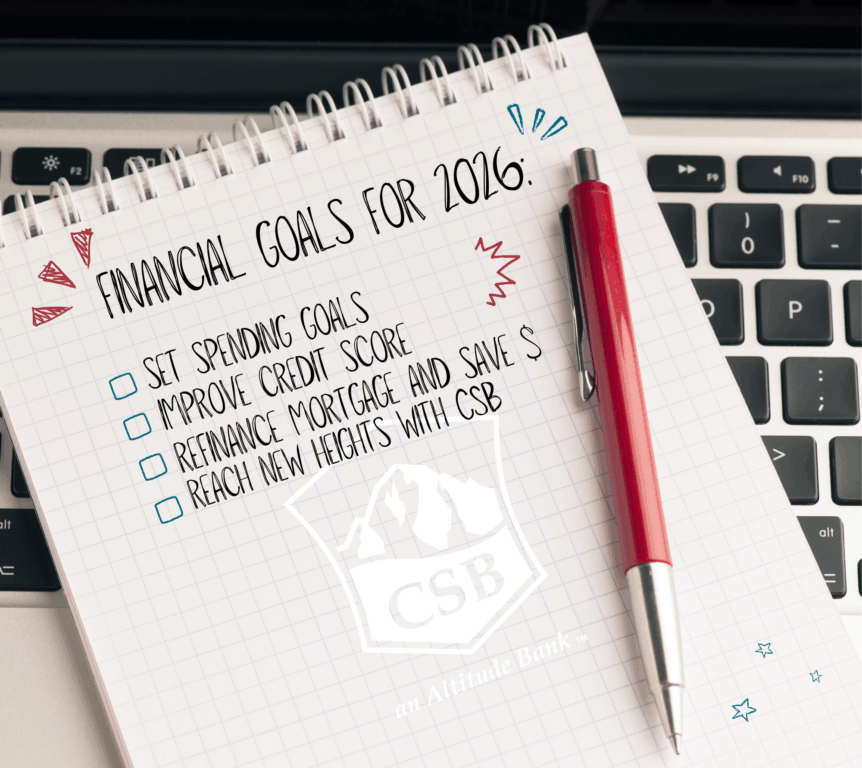

With the New Year upon us, it’s the perfect time to connect, care for your future, and set up a strong start to 2026. Whether you’re tracking spending, saving more, or planning big goals, CSB’s tools and friendly local bankers are here to support you—online, in-app, and in-branch.

Stress‑Free Spending with My Spending

Start the year in control—keep your budget on track with My Spending in the CSB app. See your predicted balance after upcoming bills, categorize purchases, and set budget and spending alerts so you never overspend by accident.

- Predicted balance shows what’s safe to spend after scheduled payments.

- Create category budgets (gifts, travel, dining) in minutes.

- Get alerts when you’re nearing or crossing budget limits.

>>Download/Open the CSB App and turn on My Spending today!

Give Yourself the Gift of Refinancing with Altitude™ Mortgage

Lowering your monthly payment or shortening your term can fuel your New Year goals for 2026. Explore a refinance with Altitude™ Mortgage—our team will review options, costs, and timelines, so you can decide with clarity and confidence.

- Potential to reduce monthly payments or total interest paid.

- Consider cash‑out options for projects or debt consolidation.

- Local guidance with quick, clear next steps.

Equal Housing Lender. Loans subject to credit approval and program eligibility.

>> Schedule a mortgage check in or call us at 970-650-8718.

Give Back & Maximize Your Impact

The New Year is a great time for generosity—and intentional financial planning. Charitable donations can help you maximize tax benefits while supporting causes you care about. Citizens State Bank supports community giving through Altitude™ Giving – our philanthropy program.

- Donations to qualified charities may be tax-deductible—check with your tax advisor.

- Support local nonprofits through Altitude Giving initiatives.

- Give online or in-branch—ask us how to participate.

New Year Goal Setting with My Credit Score + My Spending

New Year, clear goals – start 2026 with confidence! Monitor your credit health with My Credit Score, and pair it with My Spending to create category budgets and set alerts. Small steps—like automating savings or tracking credit utilization—can become big wins by mid-year.

- Turn on My Credit Score in the CSB app to track changes monthly.

- Build simple budgets (Groceries, Gas, Gifts) with My Spending.

- Automate weekly transfers to savings—consistency is key!

- Keep credit card utilization under 30% for healthier scoring.

- Set calendar reminders for quarterly check-ins.

>Log in to the CSB app and turn on My Credit Score to begin.

Want a fresh-start printable or to share with someone? Click HERE to download a PDF of the CSB Spend Smart Save Bright Guide.