With the New Year upon us, it’s the perfect time to connect, care for your future, and set up a strong start to 2026. Whether you’re tracking spending, saving more, or planning big goals, CSB’s tools and friendly local bankers are here to support you—online, in-app, and in-branch. Stress‑Free Spending with My Spending Start the year in control—keep your budget …

Financial Planning: Getting Ready for the End of the Year

Table of Contents: This time of year is the perfect time to reflect on your financial year and prepare for what’s ahead. Even if you had a terrific year highlighted by sticking to your budget, funding an emergency savings account, and paying off debt, there are likely still goals that you would like to accomplish next year. By assessing your …

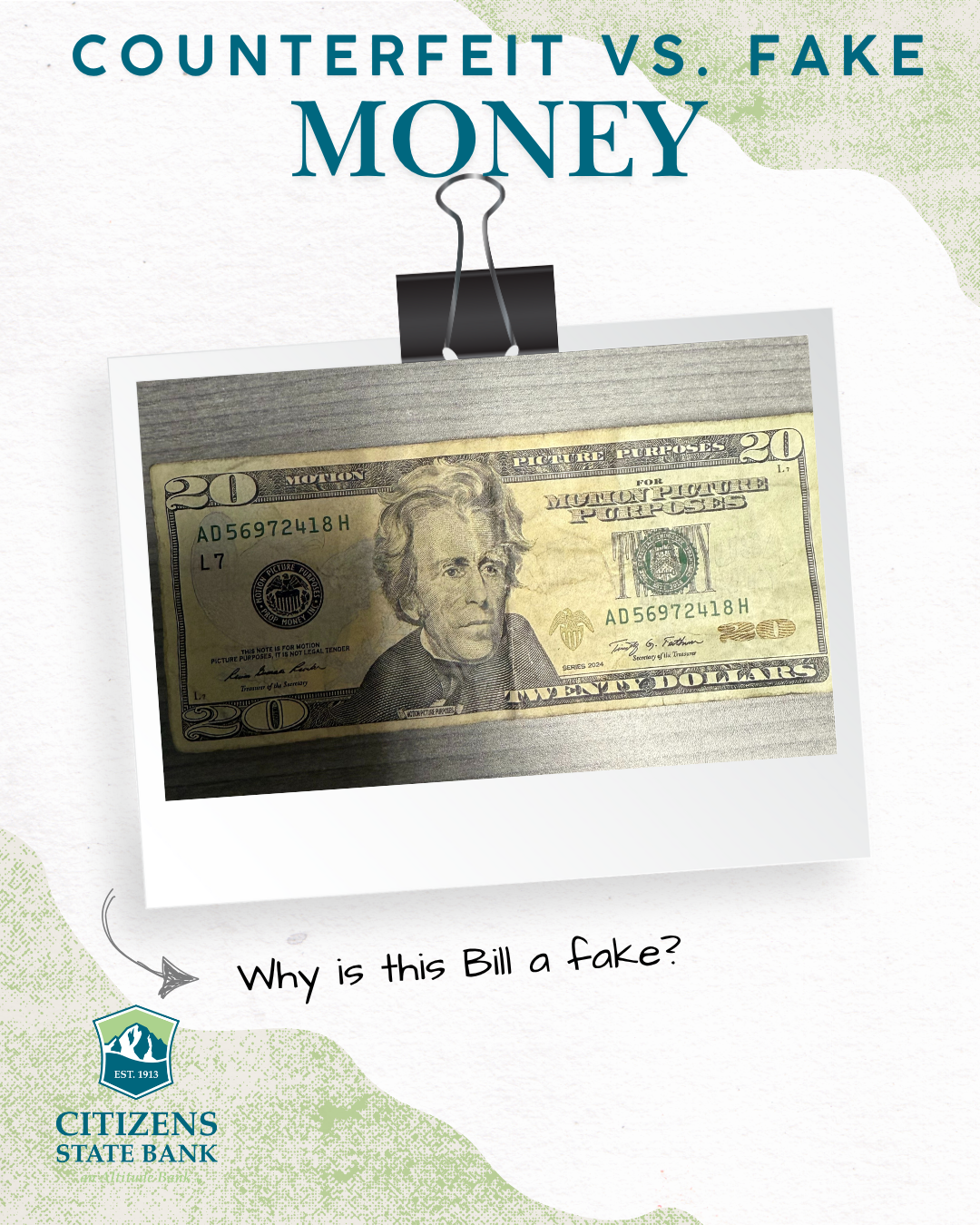

Counterfeit vs. Fake Money: What’s the Difference and How to Spot It

Fake bills are making their way into local businesses. But not all “fake” money is the same. Some bills are counterfeit (illegal and intended to deceive), while others are prop money (legal for entertainment but not for transactions). Not all money is created equal; here’s what you need to know. Counterfeit vs. Fake (Prop) Money Counterfeit Money Created to deceive …

CSB CEO Delivers National Keynote at Federal Reserve Conference

On October 7th , Citizens State Bank President & CEO Alexander Price delivered the Community Banker Keynote at the 2025 Community Banking Research Conference, hosted by the Federal Reserve Bank of St. Louis. This prestigious event brought together leaders from across the country to explore the future of community banking—and we’re proud to say our Western Slope communities were front …

The End of the Penny: What It Means for You and Your Business

The U.S. Department of the Treasury has officially ended production of the penny, marking a historic shift in American currency. While the penny remains legal tender, banks—including Citizens State Bank—can no longer order new pennies from the Federal Reserve. This change is impacting retailers, banks, and consumers across the country. Why Is Penny Production Ending? The decision stems from rising …

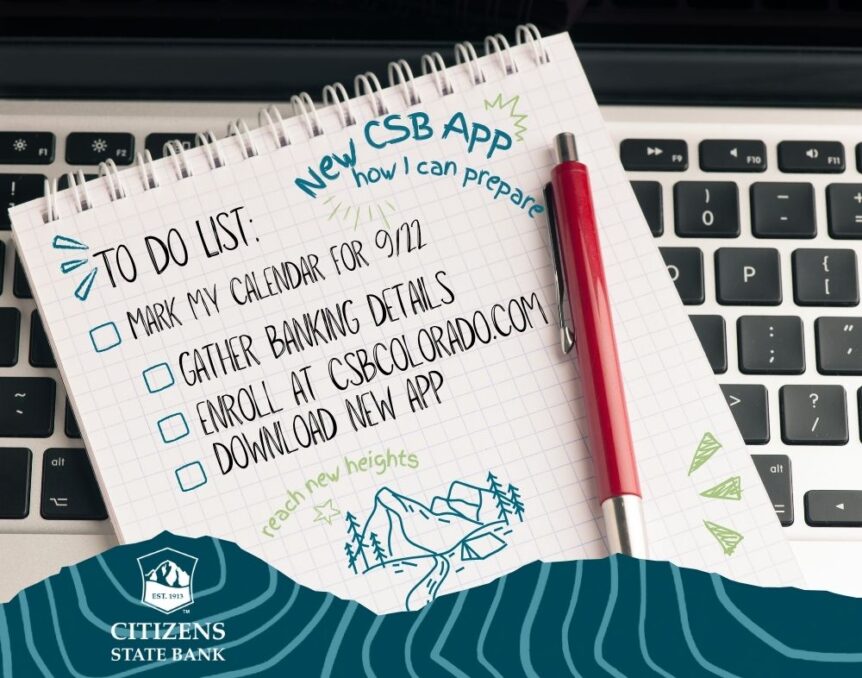

Online Banking – Enrollment Overview

All customers must enroll to use the new system – available on desktop and mobile (site and app). 1. On our website, here, Click on ONLINE LOGIN (top right on menu) to begin the enrollment process. Select either “Enroll” OR “Business Enroll” to begin the enrollment relevant to your account with CSB. If you have both business and personal accounts, …

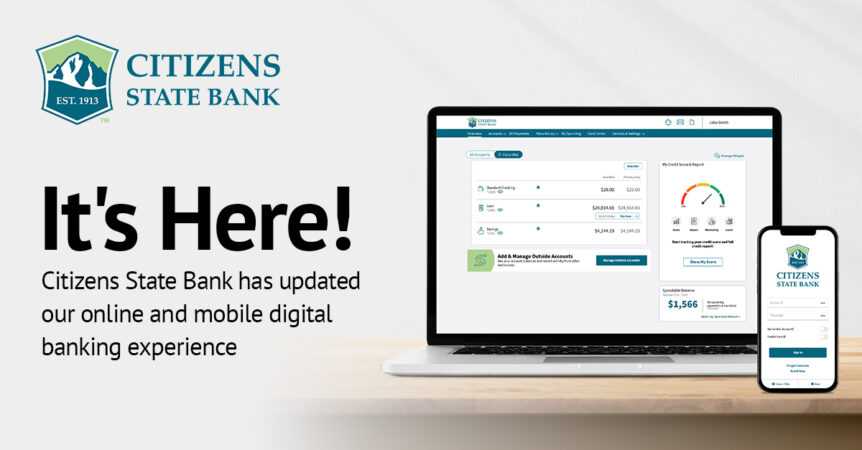

Get Ready: Enhanced Online Banking Goes Live September 22

We’re excited to share that Citizens State Bank is launching a brand-new online banking experience on September 22! This upgrade brings a fresh look, improved features, and a more secure way to manage your finances — anytime, anywhere. Important: Our current online banking platform will be retired on 9/22. To continue accessing your accounts, all customers must re-enroll using the …

Change is in the air!

The leaves won’t be the only thing changing this Fall! Citizens State Bank is working hard to upgrade our online banking experience to make managing your finances easier and more intuitive. Our NEW online banking platform will replace our existing one – providing you with more features and services available 24/7 at your fingertips. We are working hard to make …

Affordable Holiday Activites and Local Events in Colorado for the Holiday Season

Table of Contents Exploring Holiday Traditions Local Community Events Affordable Holiday Activity Ideas Get in Touch with CSB For many people, the holiday season is filled with shopping, celebrations—and stress. Family gatherings and finding the right gifts can be a source of joy and stress at the same time. Financial concerns are a top cause of stress during the holidays. …

Cyber Security and Protecting Your Financial Information

Table of Contents Every year, the risk of cyber security threats continues to grow. In 2023, there were over 2,300 cyber attacks in the US, with more than 300 million victims of these scams. By 2028, it’s predicted that cybercrime will cost the country nearly $2 trillion. With October being Cybersecurity Awareness Month, we’re here to offer advice and guidance …